You may be entering the job market, you may be thinking about switching careers, or simply you are curious to know whether 45k is a good salary in the UK, either way, it is interesting to understand if one can become rich with a salary that large.

In this article, we are discussing housing, tax, living costs, and other factors that can influence how far your 45k salary might increase it.

Contents

- 45K after tax UK

- UK’s Living costs

- Accommodation and Housing

- Saving potential and financial considerations

- Future earnings and career progression

- People May Also Ask

- Is 45000 a good salary in UK?

- How much is a good salary in the UK?

- Is 44k a good salary in the UK?

- Is 40k a high salary UK?

- How much tax do I pay on 45000 a year UK?

- How much is 45000 after tax UK a month?

45K after tax UK

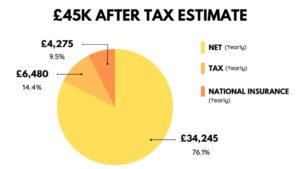

So, if you’re searching for a new job or have recently been hired at an annual income of $45k, here is how your net salary would amount to:

- National insurance – £4,650

- Income tax – £6,480

- Take home pay – £33,860

With a salary of £45,000, your take-home pay would be approximately £33.861 after tax and NI contributions have been taken into account. This translates to approximately £2,820 a month and £650 per week. If you require assistance with your personal tax matters, an accountant who is qualified can help you. An accountant can also help you in setting long-term goals and maintaining your finances.

UK’s Living costs

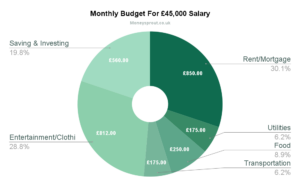

Salary adequacy is determined by living costs. The cost of living in the UK can also differ greatly depending on individuals’ location, lifestyle, and personal circumstances affect these costs. To evaluate whether 45k is a good salary, let us talk about some areas of expenditure:

1. Housing

Housing-related expenses continue to be the highest expense for individuals or families. In particular, in big cities such as London, the cost of buying or renting a property can be quite significant.

With a salary of 45k you should be able to find reasonable housing in most regions around the country, also it will be somewhat harder to purchase larger homes or live in areas that are expensive.

2. Council Tax and Utilities

It is also critical to count utilities, such as electricity, gas, water and the internet as vital spending. The council tax in addition is based on the value of your property as well as the local authority.

Although these amounts may differ, curbing a portion of your income towards utility and council tax is typically affordable from a 45k salary.

3. Transportation

You need to take into account the cost of owning or commuting your vehicle when calculating your salary. Fares for public transport and the cost of fuel may differ based on where you live, your destination and distances travelled. 45k salary, you should be able to afford transportation costs without it impacting on your earnings negatively.

4. Dining Out and Groceries

Another important aspect to consider is the cost of food. While the prices may vary, especially in rural or urban areas, a 45k salary allows for a good grocery budget and now and then eating out.

5. Entertainment and Leisure

Your salary too must allow for leisure entertainment and activities. With a 45k salary, these pursuits including going to the attending concerts, cinema, or engaging in hobbies should not be very financially straining.

With the areas of expenditure listed above, a 45k salary typically gives a person enough to meet basic living expenses and enjoy a comfortable lifestyle for most parts in the UK.

Accommodation and Housing

As was earlier discussed housing costs can greatly influence whether or not a salary is adequate. The housing market in the UK is different from one region to another and normally higher prices are seen in areas like London or south east.

Let us talk about the housing options that you can get on a 45k salary:

1. Renting

Many people opt for renting, especially those who like freedom or don’t possess enough money to purchase real estate. 45k salary you should be able to afford a decent rental property in most parts of the nation. But in places with high demand such as London, you might need to be frugal and consider shared accommodation or dwelling on the outskirts.

2. Buying

Purchasing property is a long-term investment that provides stability and growth potential. Though the affordability can differ in different regions; there are chances for owning properties at a salary of 45K.

Essential expenses like insurance, maintenance, mortgage payments, and stamp duty must be considered as well when the idea of purchasing a home arises.

It is worth noting that there are government assistance and schemes programs aimed to help first-time buyers get a property cheaper than their 45k salary.

Important Links

Saving potential and financial considerations

Living and housing expenses aside, it is also important to pay attention to financial well-being and the likes of a 45k salary. Here are some aspects to keep in mind:

1. Savings

It is important that you allocate a part of your income for emergencies, retirement and future plans. With a salary of 45k annually, you can save a decent sum each month and set aside funds to create an emergency fund along with efforts to accomplish your financial goals.

2. Pension contributions

Pension is an essential element for long-term financial security. On a 45k salary, you should be able to regularly contribute towards your pension scheme and take advantage of any employer contributions and tax relief.

3. Debt management

If you already have these debts, such as credit card balances or student loans, surely they should be managed correctly. 45k earnings should enable you to pay off your debt repayments without too much strain and start trying to eliminate the overall burden of these debts.

4. Financial planning

It is good to think of working with a financial consultant who can guide you on how best to use your salary.

They can help you come up with a complete financial plan so that you are in the best position to optimize your earning potential, invest and even make sound decisions regarding money matters.

Future earnings and career progression

Considering a salary of 45k, assessing your career plans and potential future income is important. Many people want to further their careers, assuming more responsibilities or looking for opportunities for professional development.

As time goes by, you are likely to be paid more, which can help you build a better financial position and earn a higher income. Moreover, it should be kept in mind that salary is only one of several factors contributing to job satisfaction and overall financial prosperity.

Other factors such as work-life balance, personal satisfaction, and benefits should also be considered in evaluating an employment position.

45k, is it a good salary?

45k salary, and it entails that an individual can maintain a decent lifestyle in the UK. This is the means to cover living expenses, such as housing, utilities, transport and even leisure time activities.

It also enables one to save for long-term objectives and financial stability. However, it is also important to note that personal choices, individual circumstances, and regional disparities determine a salary’s adequacy.

A 45,000 dollar salary could also be evaluated by looking at your lifestyle preferences, financial goals, and future ambitions. Do not forget to make sound financial decisions, manage expenses carefully and seek advice of a professional wherever necessary.

With a proactive attitude towards your finances, you can use the 45k salary to your advantage to enjoy financial success.

People May Also Ask

Is 45000 a good salary in UK?

In the UK, £45k is considered above average and should be more than sufficient to live on if you are smart with your money. However, if you have dependents or live in an expensive part of the country, it may be more difficult for you to make ends meet. Budgeting would help you in accounting for your day-to-day and monthly living expenses.

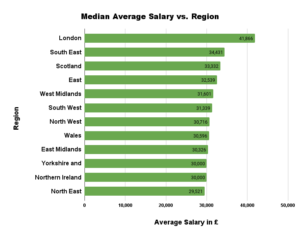

How much is a good salary in the UK?

The average annual salary in the UK is £29,600 a year (£1,950 a month). 40, 000 a year is considered to be a good income and this national average is much lower than that.

Is 44k a good salary in the UK?

40,000£ is a good salary and, in general cases, there is no need to earn more than that even for your own maintenance. It is a little above the median wage for the UK, although slightly below London’s, though of course changes will depend on your current parental financial situation and how many dependents you have.

Is 40k a high salary UK?

A good salary in most parts of the UK is £40k per annum. This works out to £6,720, which is more than the median average salary, which is £33,280. The UK place with an average salary of £40k is only London.

How much tax do I pay on 45000 a year UK?

Living in the United Kingdom and earning £45,000 a year will result in an annual tax of £10781. This implies that your net pay will be £34,219 annually or £2,852 monthly. 24.0% is your average tax rate and 33.3% is your marginal tax rate.

How much is 45000 after tax UK a month?

On a salary of £45,000, your take-home pay is £33,861 after tax and National Insurance. This represents £2,822 per month or £651 weekly.

I am a passionate technology and business enthusiast, constantly exploring the intersection where innovation meets entrepreneurship. With a keen eye for emerging trends and a deep understanding of market dynamics, I provide insightful analysis and commentary on the latest advancements shaping the tech industry.