Current rates and allowances: The amount of Income Tax you need to pay each year depends on:

- How much of your money is higher than your Personal Allowance.

- How much of your salary is in each tax level.

- The present tax year starts on April 6, 2023, and ends on April 5, 2024.

Contents

Your Personal Allowance tax-free

The normal Personal Allowance is £12,570. This is the money you earn that you do not have to pay taxes on.

Your Personal Allowance may increase if you use a Marriage Allowance or a Blind Person’s Allowance. It is less if your income is more than £100,000.

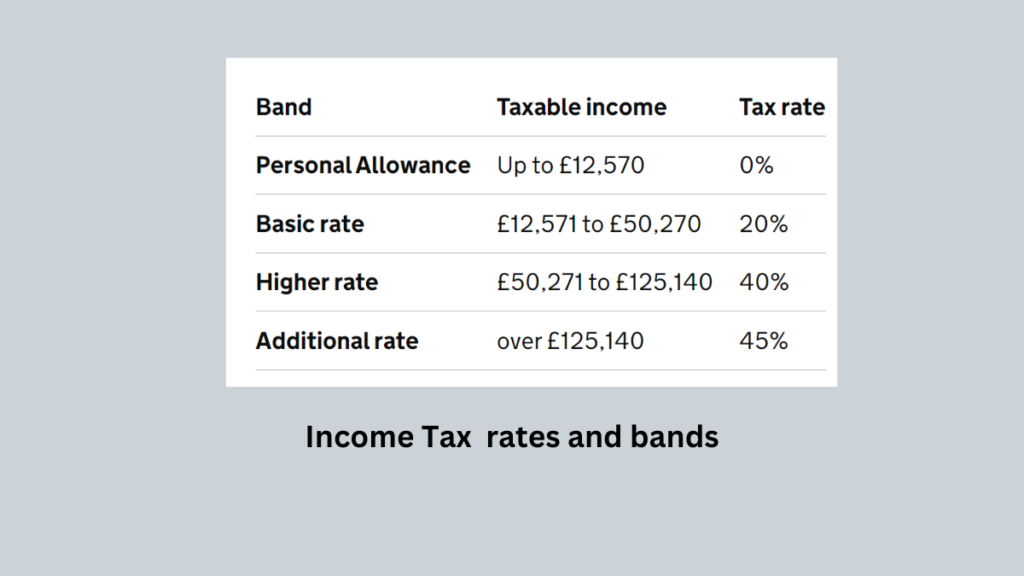

Bands and Income Tax rates

The chart shows how much tax you pay in each group if you have a Personal Allowance of £12,570.

You can also view the amounts and levels without the Personal Allowance. You can not get a Personal Allowance for taxable income above £125,140.

If you have a job or receive money from retirement:

Check your Income Tax to know:

- Your personal allowance and tax number.

- How much money you have given as tax in this year.

- How much you pay for the rest of the year.

Other allowances

You have allowances(tax-free) for:

- dividend money if you own parts of a company’s shares.

- savings interest

You may also have allowances(tax-free) for:

- Your first £1,000 of money you earn from being self-employed – this is called your ‘trading allowance’.

- The first £1,000 you earn from renting out property (not counting the Rent a Room Scheme)

You must pay tax on interest, dividends or earnings above your limit.

Related Articles

| Working Tax Credit: How Much You Get |

| How Much is Carers Allowance 2024? Check Rate, Eligibility |

| Direct Taxes Rates and Allowance |

| Marriage and married couple’s allowance |

Paying less Income Tax

If you are eligible, you may be able to get Income Tax reductions.

If you are married or in a relationship with someone of the same gender:

- You can get a Marriage Allowance if your money is less than the normal Personal Allowance. This can help reduce how much tax your partner needs to pay.

- If you do not use Marriage Allowance, and you or your spouse are older than April 6 1935, then you could get a Married Couple’s Allowance.

People May Also Ask

Is personal allowance subject to tax?

Usually, all allowances are added to an employee’s total income unless they are not allowed. The extra money is on top of the normal pay and taxed based on rules made by laws about earning money.

What is personal allowances in salary?

Money given by the employee to workers for spending, more than their main pay, is called Salary Allowances. Employers give their workers extra money benefits separate from basic pay. These are called salary allowances.

What are fully tax-exempt allowances?

The boss might give you money for your kids’ schooling as part of your paycheck. The money given by an employer for kids’ education does not get taxed.

I am a passionate technology and business enthusiast, constantly exploring the intersection where innovation meets entrepreneurship. With a keen eye for emerging trends and a deep understanding of market dynamics, I provide insightful analysis and commentary on the latest advancements shaping the tech industry.