We are here to discuss all about the State Pension Increase from 2024 to 2025. In this article you will get to know what the expected increase from 2023, 24, and 25. Latest updates about the State Pension Increase 2024-25 and what is the expected increase from 2023, 24, and 25 and other important things are included in this article.

State Pension Amount Increase 2024

Due to a triple lock, the state pension will increase by 8.5% in 2024. You should know that the triple lock system was introduced in the year 2011, and after that, it was executed (not in 2022/23). Basic and new state pensions must be increased by the government annually, in the average earnings’ accordance.

The government is bound to increase the state pension either by 2.5% or CPI inflation because of the triple lock, whichever of them is the maximum average growth of earnings. Moreover, the state pension increase is because of the triple lock that makes up with time.

How Much is the Expected State Pension Amount Increase 2024 2023, 24 and 25?

There are a total 3 types of state pensions introduced by the UK Government: Basic, New, and additional. You should be aware of the fact that the state pension totally depends on the National Insurance Contribution. Mainly, to qualify for any type of state pension, a person requires about 10 years.

It is not necessary that 10 years should be consecutive. Moreover, the state pension is for those who have reached the age of acquiring the state pension.

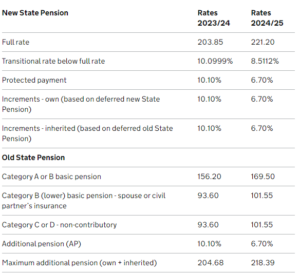

To qualify for the state pension, an amount of £156.20/week is paid under the basic state pension, whereas an amount of £203.85/week is paid to the new state pension. However, there is no fixed amount for the additional state pension category.

With the increase in the pension, the basic state pension amount increased from £169.50/week to £156.20/week. Meanwhile, the amount of new state pension increased from £203.85/-£221.20/week.

Because of this increase in the state pension, the amount per annum that beneficiaries get will become more than the annual amount of the previous year. If you want to know more about the state pension increase, what is the eligibility, and other important things, then you can visit the official website of the UK Government.

To know the exact pension amount they got, people also use the forecasting tool for pension. It also tells the date on which they are going to get the pension amount, and also it tells the ways using which their pension amount can be increased. But, to use this service, people require an account with Government Gateway.

There are some ways which are considered useful for increasing the pension, like paying voluntary contributions, delaying the pension, etc. Also, people can contact to financial advisors to know all the relevant ways to increase their pension, which is suitable for their situation. By using such ways, people get more personalized ways than general ways to increase their pensions.

State Pension Types

People can get 3 types of state pension, based on the National Insurance Contribution in the UK. These types are:

- Basic

- New, and

- Additioal.

But the fact is that only new and basic pension have their maximum limits but additional pension has no such limit.

New State Pension: Under this type of pension scheme, you get a maximum amount of £203.85/week. The amount depends on the total number of qualifying years or the National Insurance Record. The New State Pension payment is made every month or after 4 weeks. For more, you should know that the day for payment depends on the last two digits of the National Insurance Number.

Basic State Pension: This type of pension pays £156.20/week. It is also the same as the new state pension as the amount of the pension depends on the national insurance record.

As the amount of the pension is based on the qualifying years of pension, so those who already reached the age of getting a state pension have a sufficient number of qualifying years. If people are eligible, they are also paid more amount of pension by the additional state pension system.

It is scheduled to increase annually based on factors like prices, earnings, or a minimum of 2.5%, whichever is higher. This makes sure that the pension will increase by at least 2.5% when price and earnings factors are below that threshold.

Additional State Pension: People qualifying as men born before April 6, 1951or women born before April 6, 1953, are provided to receive it in addition to the basic state pension.

There is no need for people to submit any other application for the additional pension. If they meet the eligibility criteria, it is automatically granted. The Additional State Pension amount is paid along with the amount of the Basic State Pension. The total amount of the additional state pension depends upon:-

- National Insurance Qualifying Years

- Earnings

In case, the spouse of a person dies who was getting an additional state pension, in that case, you can inherit the amount of pension. Also you get the decreased 50% of the pension of the spouse.

I am a passionate technology and business enthusiast, constantly exploring the intersection where innovation meets entrepreneurship. With a keen eye for emerging trends and a deep understanding of market dynamics, I provide insightful analysis and commentary on the latest advancements shaping the tech industry.